Please read to the end of this document for our conclusion and recommended action steps!

References:

Actual Tax Reference Doc: https://www.irs.gov/pub/irs-drop/rp-24-28.pdf

CryptoTaxAudit’s version/recommendations: https://www.cryptotaxaudit.com/crypto-safe-harbor-allocation-plan

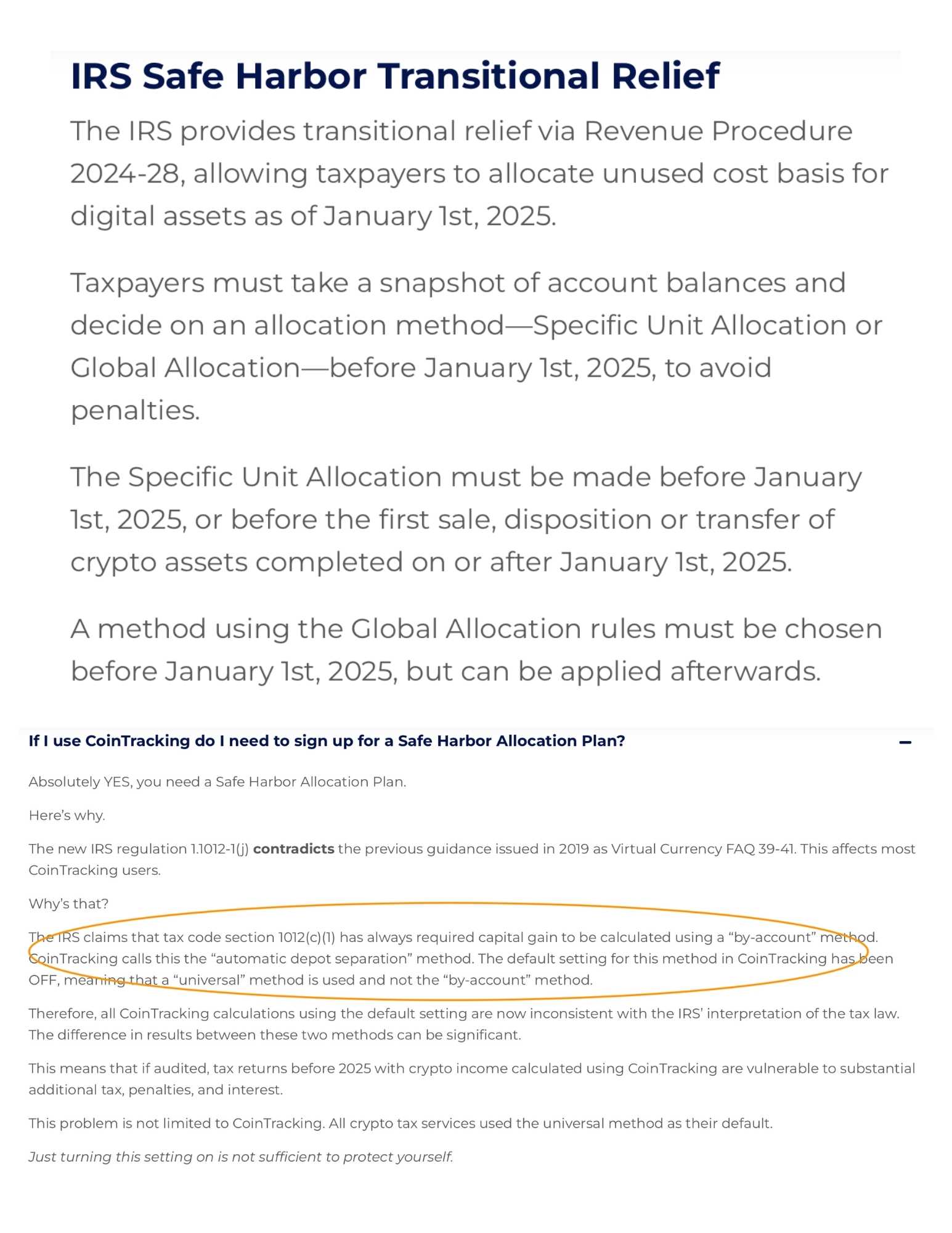

What we know:

The IRS claims that we all have been reporting our crypto transactions divided by wallet. (I.E. if you bought Bitcoin in Kraken, the cost basis of any Bitcoin sold at Kraken would be from the crypto currently in Kraken.)

Many crypto tax investors used the default setting in their crypto tax software and reported their crypto transactions dumped in one bucket. (I.E. you may have bought Bitcoin at Kraken, later bought Bitcoin at Coinbase, then sold Bitcoin at Coinbase, but your tax software defaulted to using the cost basis of the Bitcoin at Kraken because it was bought first for FIFO (first-in-first-out).)

This can cause asset allocation problems since (for example) the FIFO cost basis of a coin still recorded as being in a wallet/exchange may have been used for another coin’s sale in a different wallet/exchange.

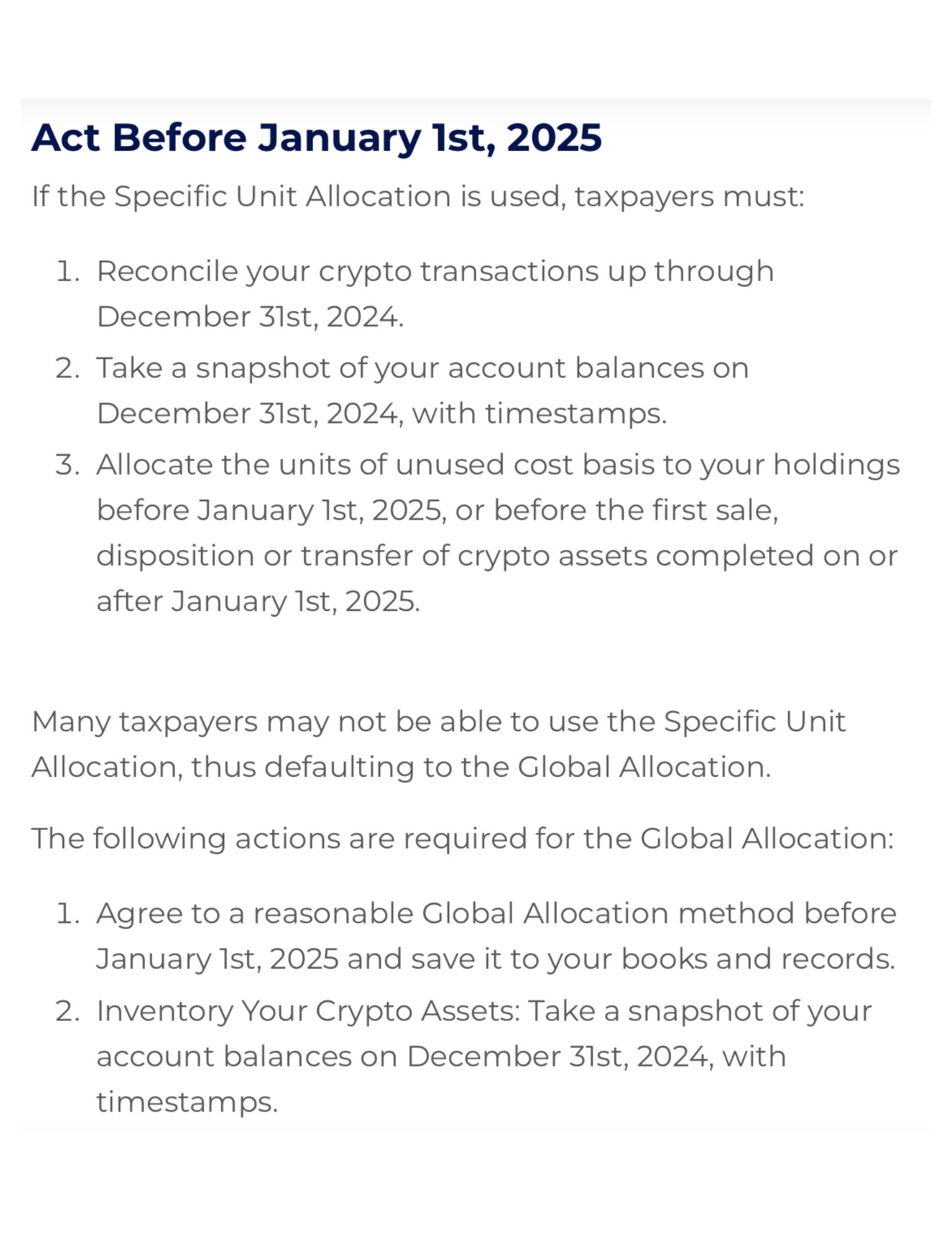

The IRS is proposing a one-time safe harbor for affected crypto investors to realign their still remaining and unused cost basis to the still remaining digital assets. BUT action must be taken before the earliest of Jan 1 2025 or the first transaction in your wallet for 2025. (And whatever happens: you CANNOT report a coin’s cost basis as being used twice to the IRS!)

In addition, the IRS expects all crypto investors to have a default method specified for their tax reporting BEFORE a transaction is made. (You may change your method, but you have to specify it in writing before the transaction takes place -- I.E. many crypto investors were running their numbers at the end of the year and choosing the tax method that gave them the least amount of taxes due. The IRS doesn’t like this and says you have to have a standing method or are assumed to be using FIFO.)

Finally, the IRS will be requiring all exchanges to report your sales (in 2025) and purchase info (in 2026) to the IRS so they can check up on you. (Of course international exchanges and blockchain wallets will probably not comply and/or be able to comply.) Because of this info being reported directly to the IRS, it will be more important then ever to accurately report your crypto taxes and ensure you’re not double-reporting.

We suggest the best way to report your taxes depends on how complicated your situation is:

If you are only trading inside one exchange, once that exchange starts submitting your info to the IRS and sending you a copy, you can give that document to your tax preparer/tax software for your taxes.

BUT: if you are trading in multiple exchanges, sending assets to multiple wallets, defi farming, airdrop hunting, and/or more: we suggest that you use a tax software (like CoinTracking) to track your assets across all your accounts.

If you have previously reported your taxes and did not use the setting in CoinTracking for “depot separation” (i.e. keeping the assets in wallets separate), you may need to hire help to get your records in order to meet the IRS safe harbor guidelines and reassign the cost basis of your various assets to the correct remaining coins.

If you have previously reported your taxes using the setting in CoinTracking for “depot separation” (or similar settings in other tax software), you should be all set for 2025 reporting. (Although you should still follow recommendations to take screenshots of your assets in your various wallets/exchanges as of Dec 31, 2024 as well as prepare a signed statement declaring your default method of taxation, especially if you would like to use a specific identification method such as LIFO (last-in-first-out) or HIFO (highest-in-first-out).

If you do not think you will be audited and chased down by the IRS, you do not need to comply with these suggestions (for the statement or for the record-keeping).

If you would rather be safe then sorry, you should either figure this out or find someone to help you figure it out for your specific situation. (The difference in taxation between assets reported as LIFO vs FIFO, for instance, can be substantial!)

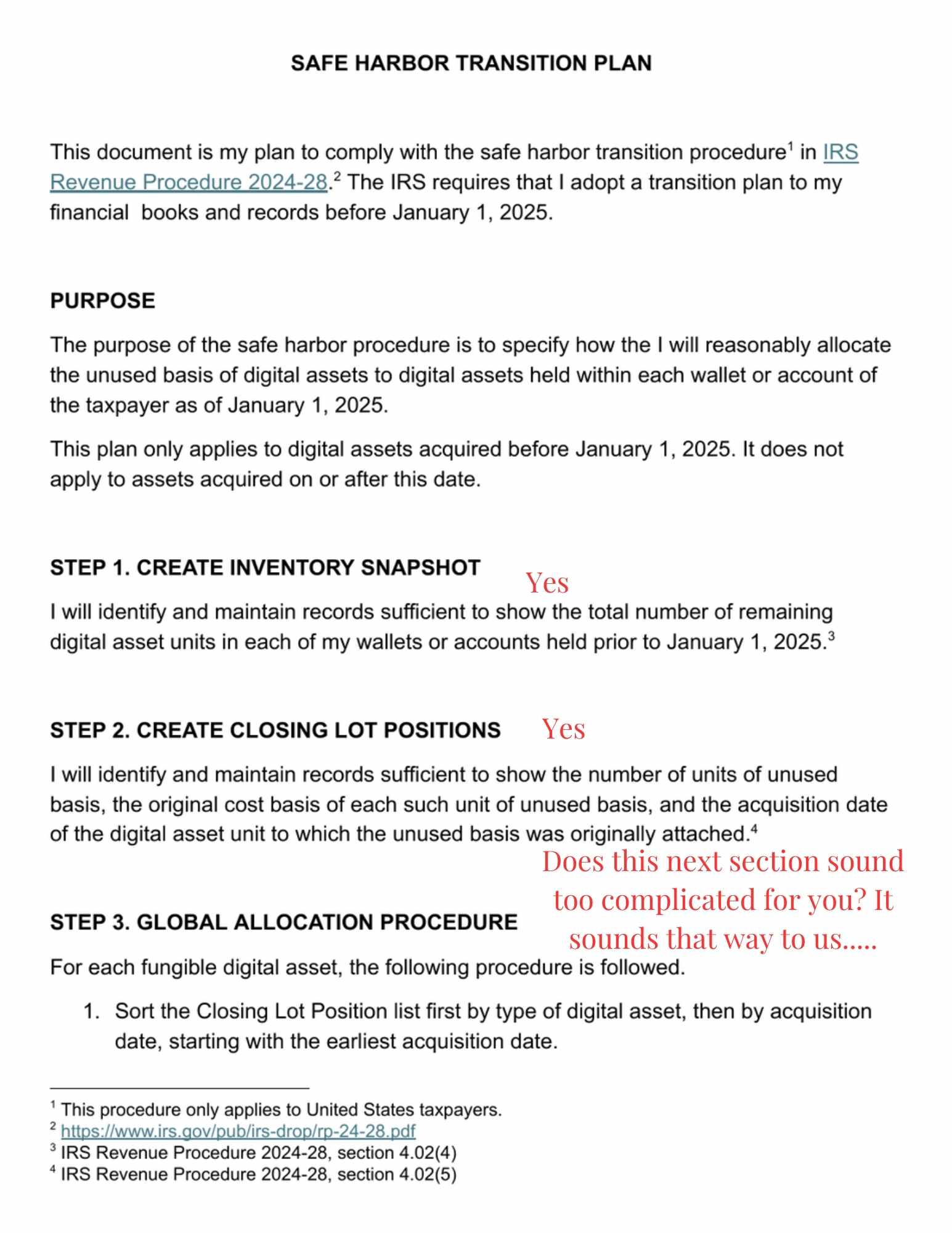

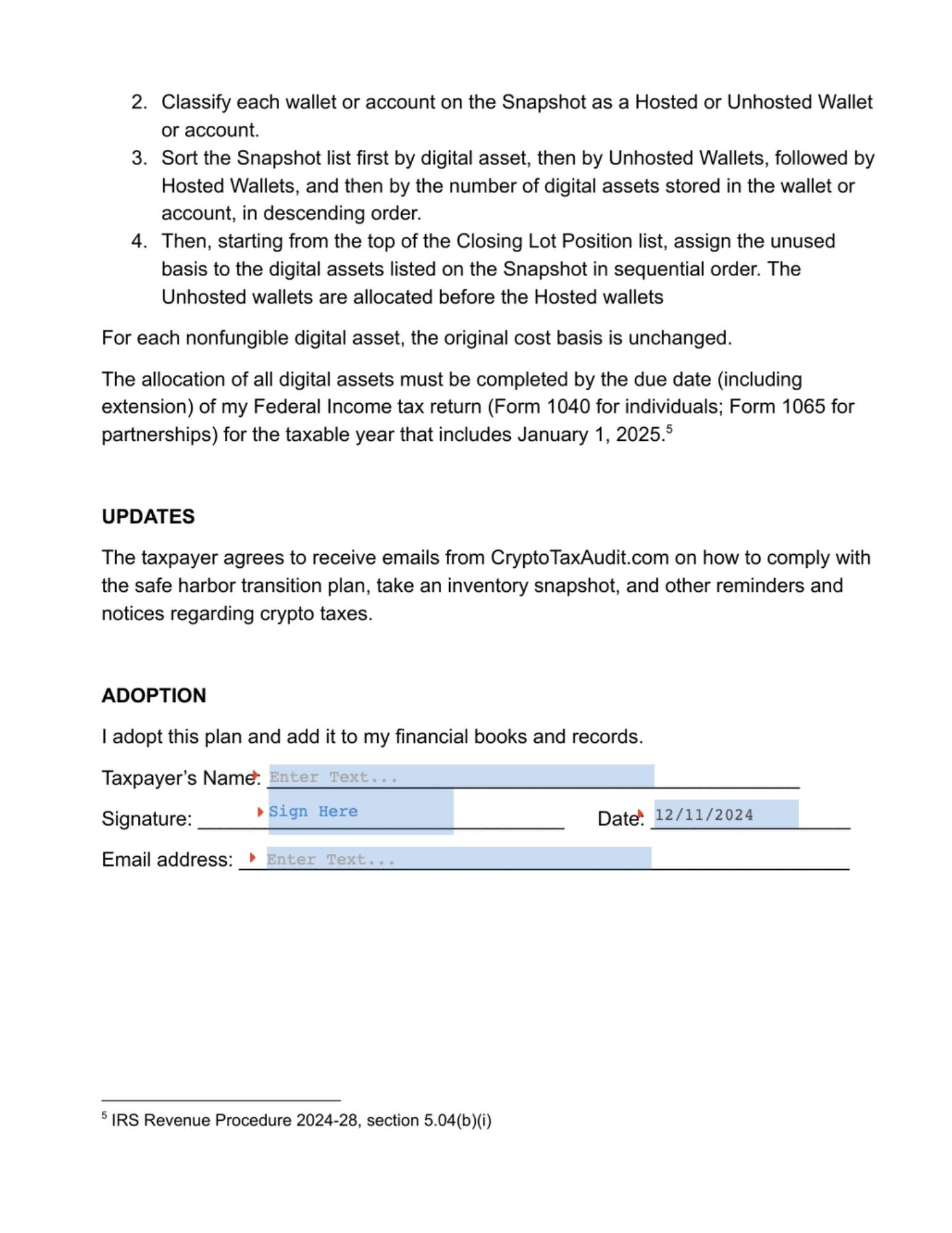

What follows are screenshots taken from the CryptoTaxAudit website (link at top of this document) regarding their recommendations for USA tax payers and screenshots of their proposed “Safe Harbor Allocation Plan” (a free document on their website that you can sign and download to meet their understandings of the upcoming requirements).

NOTE: They would love to sell you their services. You may not necessarily need them.

Also, we do not agree with their recommendation to default to the “global allocation FIFO” method. We think doing the work to put specific identification into place for your separate wallets is easier for most and well worth the effort in the future, not least because you can choose which asset in which wallet to sell which may have different implications for your taxes. (For example, you may choose to sell the 1 BTC in Coinbase because you bought it at $100k and will realize much less gains then the 1 BTC you bought in Kraken for $5K - a difference in capital gains of $95K!)

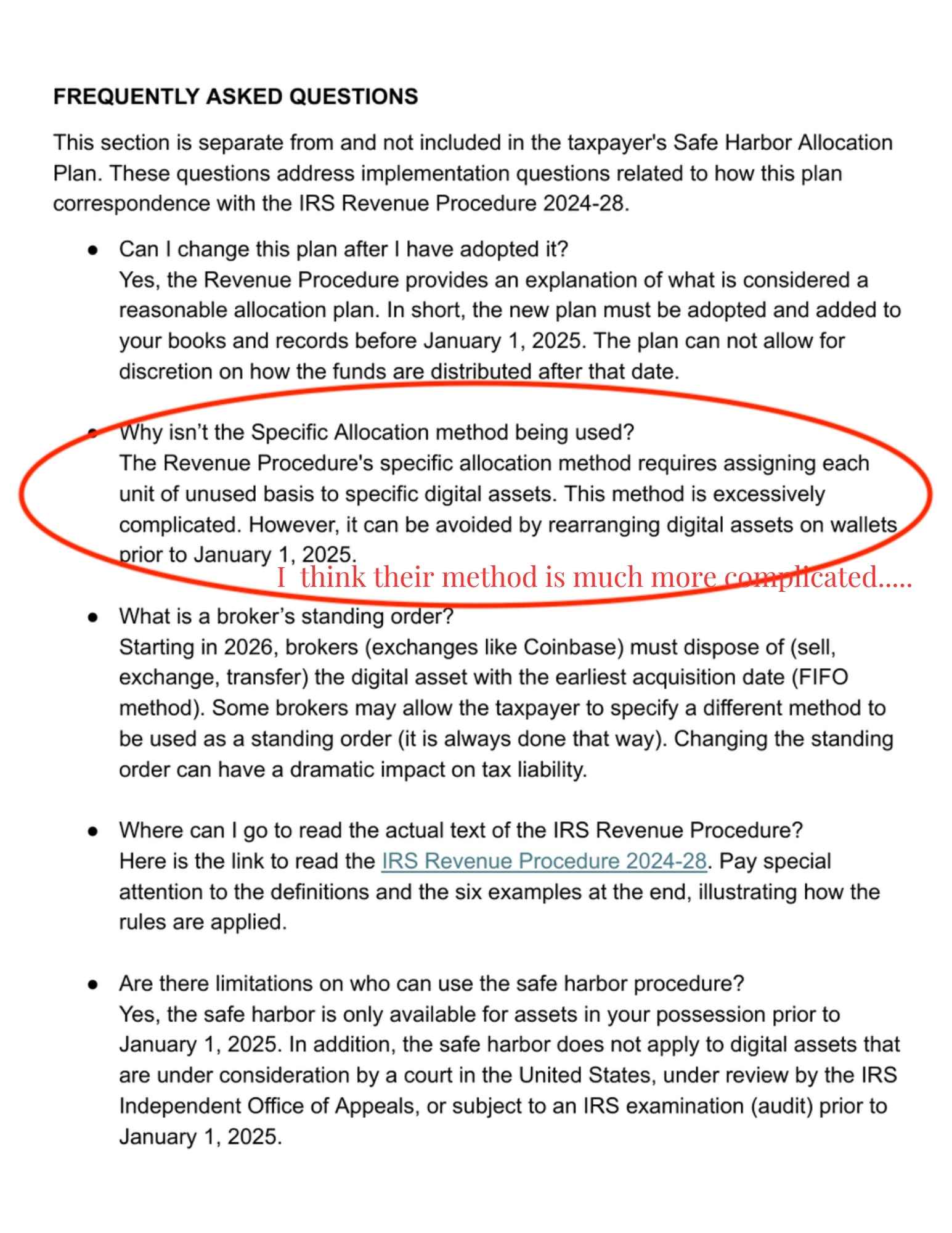

Sidenote: their examples and interpretation are actually pretty confusing. Either global allocation or specific allocation needs to be in place in your tax records before your 2025 transactions, so why use a complicated global formula when you can just use your already existing specific transactions?!

Conclusion and Recommended Action Steps:

After pondering all the preceding (and Not Financial Advice - please consult with your tax preparer and/or financial advisor to confirm their recommendations for your situation), this is what we suggest:

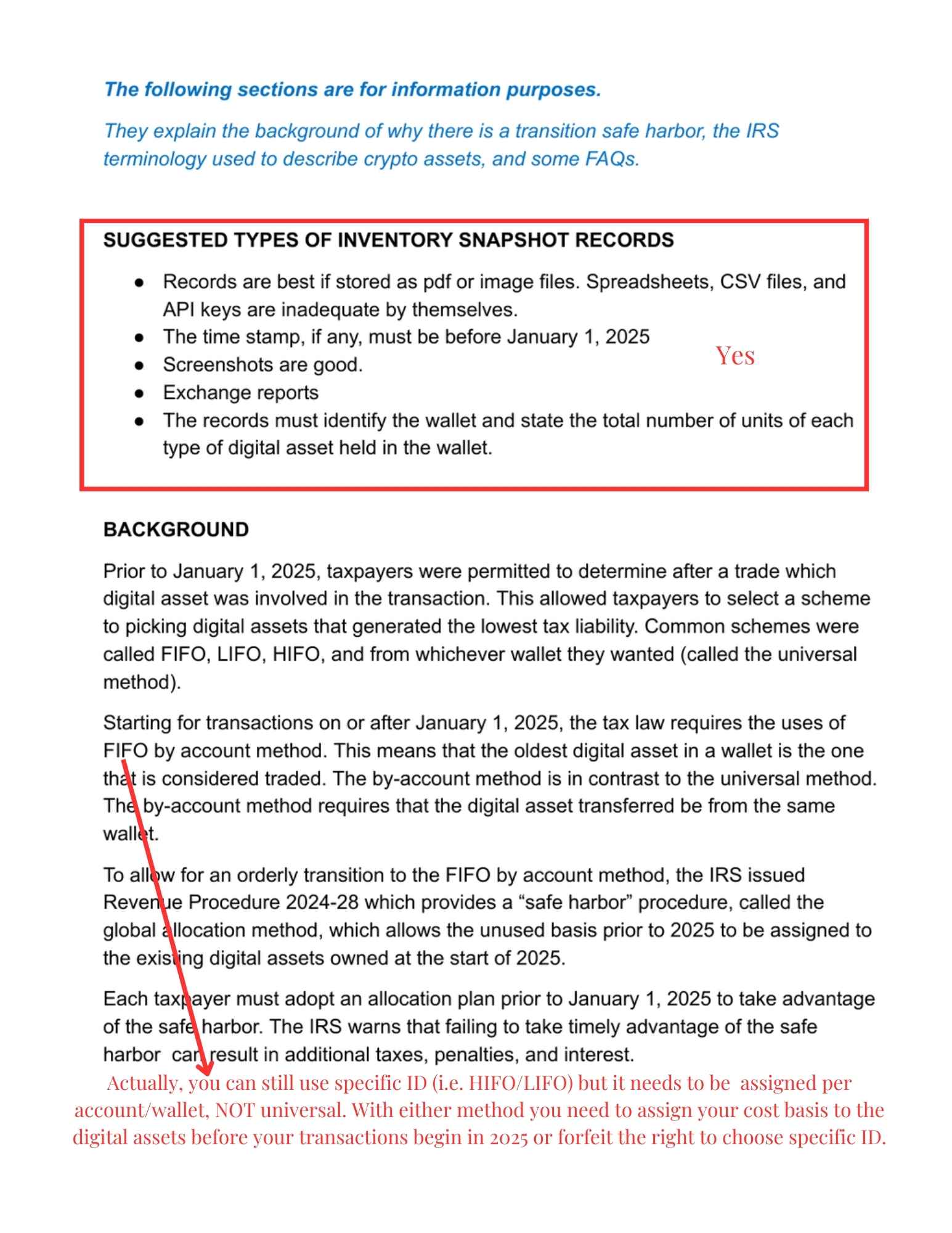

Every tax payer should follow best practices to take snapshots of their assets at the end of the day on December 31st (or the last day of their financial year) unless their exchange/brokerage provides a monthly statement with those snapshots included.

Every tax payer should specify with their exchange (for centralized exchanges that report taxable transactions to the IRS) what their preferred standing method is for disposals. (I.E. FIFO, LIFO, HIFO) Every tax payer who would like an exception to that preferred standing method for a particular transaction should communicate that to their exchange BEFORE the transaction takes place.

Every tax payer should either use a tax software to organize their taxable transactions (including the ones being reported individually by the centralized exchanges and the ones in foreign exchanges and/or on the public blockchains) to enable their tax reporting OR should be in communication with their exchange about the specifics being reported regarding transactions that started in another wallet/exchange.

(Recommended) If a tax payer has assets outside of the centralized exchanges required to report transactions to the IRS, that tax payer should sign a statement and keep it in their permanent records to the effect of declaring a standing method (i.e. FIFO, LIFO, HIFO) BEFORE Jan 1, 2025 and/or before each specific transaction takes place.

Notes to the preceding:

A. Most crypto tax software is currently not specific enough to individually assign particular transactions to a different method. You may have to keep your records with something else if you want to individually assign lots outside of a general method for the year. However, some crypto tax software (ex. CoinTracking) DO permit and track changing methods between years. See your preferred software for more info.

B. We believe the statement could be as simple as: I am choosing to use Last In First Out (LIFO) as my default tax method for all disposals of crypto/digital assets. (Or add specific references to particular exchanges as needed.)

C. We believe you should have the statement prepared and confirmed before the effective date. (For instance, take a screenshot or save a permanent copy of the document that is dated before Jan 1, 2025.)

D. The IRS will not ask you for this info unless they decide to audit you. It is up to you to have this in place in the event of an audit.

Every tax payer should determine if they need a Safe Harbor Allocation Plan or not. If needed, they should make plans to specify and carry out the plan before the earliest of January 1, 2025 or their first transaction (purchase, sale, receipt of crypto, or move) in 2025. See the following:

A. If a taxpayer does not have any taxable transactions reported prior to 2025, a Safe Harbor Plan is not needed.

B. If a taxpayer only has taxable transactions in a centralized exchange(s) that will report their transactions and cost basis allocation for them, a Safe Harbor Plan is not needed.

C. If a taxpayer has already been using a wallet-separated method to report their previous taxable transactions (i.e. “Depot Separation” in CoinTracking or a similar feature in their chosen crypto tax software), a Safe Harbor Plan is not needed.

D. If a taxpayer previously reported taxable transactions using a universal method of reporting (i.e. the default setting for most crypto tax software), they will need to put in place a Safe Harbor Plan including taking the action steps of writing a statement of how you propose to reassign unused cost basis to currently retained digital assets as well as the record-keeping to record that you put your Safe Harbor Plan in place. (I.E. Reconcile your crypto tax software account to reflect the reassigned cost basis.)

Ideally this plan should be in place before your first transaction of 2025, especially if you want to maintain your rights to choose specific identification methods for the disposals you are reporting.

We suggest you can use something similar to the plan written out by CryptoTaxAudit and copied in this report, but we do not think it is necessary to use the complicated Global Allocation method (Step 3 of their proposed contract). It may be simpler to just state something to the effect of: “I am assigning the unused cost basis of XYZ coin in ABC wallet to the XYZ coin in DEF wallet and have recorded these cost basis reassignments accordingly in my records as of (date).”

If you have questions about your particular situation, we are happy to discuss it with you.

At Beta Virtual Assistance, LLC, we are committed to helping tax payers navigate the complications of reporting their crypto transactions to their taxing authorities with the least amount of stress and the most accuracy as possible. We help our clients make sure that their tax reports are telling the correct story for their digital assets, including accurate reporting of income received, Return of Capital for projects, and cost basis for all disposals.

We provide Do-it-yourself guidance via our Basic Package (including access to our recommended software, tutorials and guides to help you prepare your records, and access to us in weekly live Q&A sessions and our private community).

We also provide Done-for-you services via our Hourly or Premium services where we will reconcile your accounts for you. (You are responsible for providing the data of all your transactions and answering our questions about mysteries to the best of your abilities. We provide the software access and ensure the transactions are reconciled to tell the right story. Packages include reconciliation for all prior financial years, whether you previously reported or not.)

If you are interested in learning more about our services, please visit our website here:

If you would like to discuss your particular situation, please book a call with one of our crypto tax experts here:

If you would like to join our Facebook group where we discuss crypto tax issues, safety and security in crypto investing, and more, please request to join:

(Note: answer the membership questions so we know you’re not a bot or spammer!)

If you’d like to download this report as a pdf, click here:

Disclaimers/DYOR

DISCLAIMER: THE INFORMATION CONTAINED IN THIS OR ANY EBOOK/WORKBOOK OFFERED BY BETAVIRTUALASSISTANCE.COM IS NOT FINANCIAL ADVICE.

This ebook/workbook is provided for educational, informational, and entertainment purposes only. In no way should the information in this ebook/workbook be considered personalized investment advice. BetaVirtualAssistance.com and its associates are not registered investment, legal, or tax advisors nor do we broker or deal in securities. All investment and financial opinions expressed by BetaVirtualAssistance.com are from our personal research and experiences and are intended as educational only. It is important to do your own research before making investment decisions regarding any particular company or investment security. Past performance of a particular investment is NEVER a guarantee of future results. Certain investments carry large potential rewards but also large potential risk. Don’t ever invest in any financial instrument with money that you can’t afford to lose. The value of your investment WILL fluctuate over time and youmay gain or lose money.More information on our Terms & Conditions and Disclaimers can be found here:

https://secure.betavirtualassistance.com/termsandconditions

AFFILIATE DISCLOSURE You should assume any links in this ebook/workbook are 1. affiliate links, 2. links to our own products, or 3. links for your convenience. We only recommend products that we whole-heartedly endorse and any commissions earned from your purchases do not increase your costs.